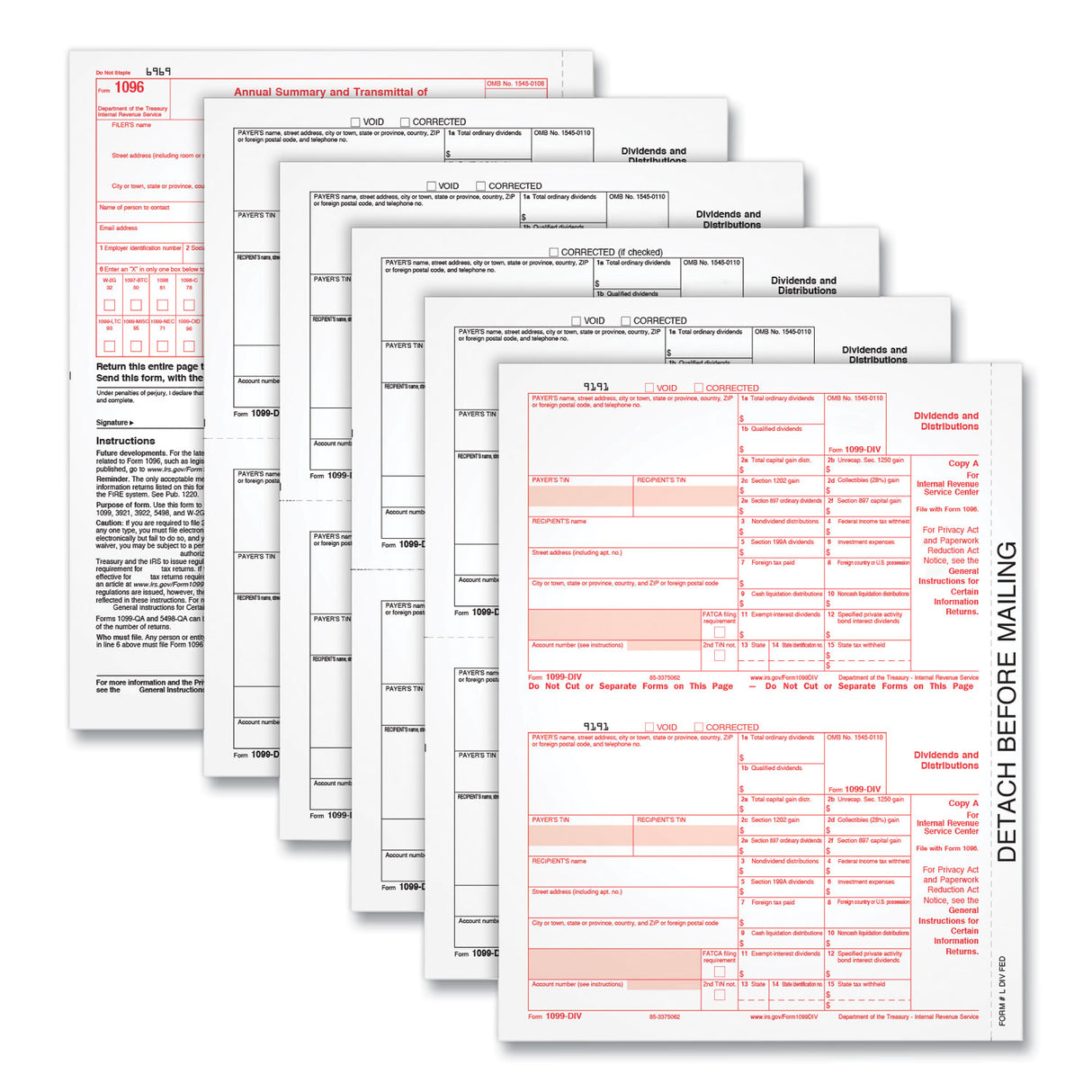

TOPS 5-Part 1099-DIV Tax Forms for Inkjet/Laser Printers, Five-Part Carbonless, 8 x 5.5, 2 Forms/Sheet, 24 Forms Total (22973)

TOPS 5-Part 1099-DIV Tax Forms for Inkjet/Laser Printers, Five-Part Carbonless, 8 x 5.5, 2 Forms/Sheet, 24 Forms Total (22973) is backordered and will ship as soon as it is back in stock.

Couldn't load pickup availability

Description

Description

Tax form pack includes five-part 1099-DIV form sets and 1096 summary forms for your recipients and the IRS. Youll use the 1099-DIV to detail gross dividends and other distributions valued at $10 or more on stock investment expenses, capital gain dividends, non-taxable distributions and liquidation distribution. As of 2022, Form 1099-DIV is an IRS continuous-use form, with a fill-in-the-year date field that makes it suitable for multiple tax years. The IRS will no longer issue annual revisions to these forms and instructions. All TOPS tax forms employ acid-free paper and heat-resistant inks to help you produce smudge-free, archival-safe tax forms with the scannable red ink required by the IRS for paper filing. Forms meet all IRS specifications. Compatible with QuickBooks and other accounting software packages. For Inkjet & Laser Printers. Form Type Details: 1096; 1099-DIV; Dated/Undated: Undated; Forms Per Page: 2; Forms Per Page Layout: Vertical: Two Down.